How fast? Try a $47 million jump from last year to this year. Ohio school districts now lose $330 million to vouchers that pay for students to attend private, mostly religious schools. And the school year isn't even halfway complete. Another enrollment period happens after Jan. 1. So we may be looking at $350 million lost to vouchers by the end of this school year.

And this is just the voucher deduction. There a whole other explosion going on in the EdChoice income-based voucher program, but since it's not a pass-through deduction from school districts, it will be more difficult to track.

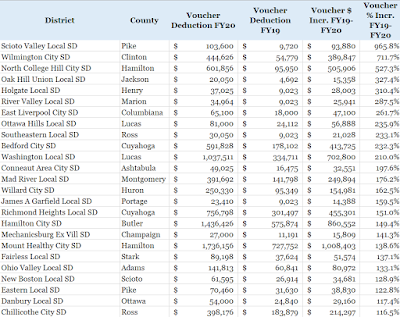

Despite that, some districts have been absolutely devastated by these increases. Take Scioto Valley Local in Pike County. Two years ago, they lost zero students to vouchers. Last year, they lost $9,720 to vouchers. This year? $103,600.

That's $100,000 that Scioto Valley had coming from the state two years ago that they no longer have. That's a lot of money to Scioto Valley. They only raise $148,000 for every voted mill they put on the ballot.

But it's not good really anywhere. Cleveland's losing another $6 million. Parma $2 million. Middletown $485,000.

And even wealthy suburban districts are getting hit.

Lakota Local in Butler County is losing $403,000 more. Gahanna in Franklin County is losing $355,000 more.

Rural districts are getting hammered too, with some losing more than 400% more money this school year than they did two years ago. And even though it's not millions of dollars, some of these districts only raise a few tens of thousands of dollars for every mill of property tax they can put on the ballot. So in relative terms, these dollar losses can be even more devastating than the millions more lost in some school districts.

What gives? Well, there are now more than 1,000 school buildings who have qualified to be a voucher building, which means at some point in their past or present they received a D or F on one of several report card measures between 2014, 2018 or 2019 (2015-2017 were classified as safe harbor years because of the many testing changes that occurred then).

But it doesn't matter if those buildings had As in everything else. If they received a D or F in two of those 3 years on overall performance, student growth, graduation, or the third-grade reading guarantee, they are now eligible to be a voucher building.

So now you have buildings in some of our state's wealthiest, highest performing districts eligible for vouchers. Like Parkside Elementary School in Solon, which is traditionally a top 5 or 6 performing school district in the entire state. Or Barrington Road Elementary School and Hastings Middle School in Upper Arlington.

These schools are all extremely wealthy. And now, the wealthy parents who send their kids there can qualify for public subsidies to send their kids to a private school.

I know. Crazy, right?

But not really. This has always been the plan. It's why Akron industrialist David Brennan started vouchers in the first place more than 20 years ago. His goal was to get the state to pay every student to attend Akron St. Vincent St. Mary's High School.

It looks like Mr. Brennan, who died last year, will finally get his wish thanks to the millions he and his acolytes spent on Ohio politicians since 1997.

Here are the top 25 districts in the state who have lost the most money between this year and last year to the voucher deduction:

And here are the 25 school districts whose increased deductions to vouchers have increased by the largest percentages between last year and this year: