But in the article, pro-voucher forces make a curious argument -- that those seeking to undo the harm voucher do to primarily poor and special need kids are actually trying to hurt those kids.

“It’s an all-time low for government school activists to try to rip low-income and special-needs students out of their schools right now,” said Aaron Baer, president of Citizens for Community Values.

First of all, it's not "government school"; it's "public school", which means our school. None other than Thomas Jefferson described it this way in the Land Ordiannce of 1785. "Public school" were Jefferson's words.

“It’s clear that this special-interest group cares less about what’s best for kids, and more about their own narrow social agenda. Ohio’s EdChoice program is a lifeline to tens of thousands of families. It allows underprivileged and underserved children the opportunity to find an education that best meets their needs.”

But I digress.

Here's the problem. Yes. It's true that poor and special needs students get vouchers and attend private schools using them. However, in order for that to happen, poor and special needs students in the public schools who don't take the voucher are left with fewer resources for their educations because the vouchers exist.

This is why, for example, as a state legislator I always voted against the special needs voucher that eventually became the Jon Peterson Voucher program. Because it set aside 1/3 of the money the state spent on special needs students to serve 3 percent of the special needs kids. So the voucher program would leave 97 percent of special needs students with only 2/3 of the money they needed.

Let's look at Parma with its 47% economically disadvanatged and nearly 2/3 minority populations.

Prior to losing voucher money and students, kids in Parma were slated to receive $13,663 per pupil in state and local funding for their educations. However, once all the vouchers were removed from the district, along with the students, kids in Parma only got $13,426. That's a $236 per pupil loss in total aid, which means there wasn't enough locally raised revenue to make up for the revenue these kids lost to the state's voucher programs.

So while some poor and special needs students certainly got vouchers, far more poor and special needs students in Parma got $236 less than they needed because of the vouchers.

In fact, in nearly 3 of 4 Ohio school districts, every poor and special needs student got less overall funding because of the voucher.

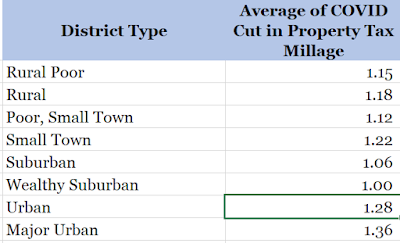

But what about those 1in 4 districts that saw greater per pupil revenue because of vouchers, you may ask? Well in those districts, the reliance on local property taxes increased as much as 10 percent, forcing those districts to tax themselves at higher rates to make up for the lost state evenue brought on by vouchers (all districts had to do this to some degree).

So in these districts (which also tend to be poorer), the need to go for levies increased at a substantially higher rate. Need I remind everyone that the Ohio Supreme Court has ruled four times that increasing reliance on local property taxes to pay for schools is unconstitutional?

I know I don't have to remind the folks who want to file this litigation because they're the same ones that won that major victory for kids in the late 1990s and 2000s.

So vouchers either directly harm poor and special needs students by cutting their overall education fudning, or force poorer communities to tax themselves at higher rates to make up for the loss of state aid from the state's voucher programs -- in clear violation of the Ohio Supreme Court's four rulings.

Oh yeah, and in 8 of 10 Ohio school districts where private voucher providers reside, the school district outperforms the private option by an average of 27 percentage points. When privates outperform districts, it's in 2 of 10 cases and by only 9 percentage points.

So not even the claim that these are better overall options for kids is true. But at leats those pushing for vouchers are willing to make sure that more than a million students in Ohio's public schools get fewer resources than they need.